Egyptian Prime Minister’s Controversial Remarks on Palestinian Issue: Analyzing the Fallout

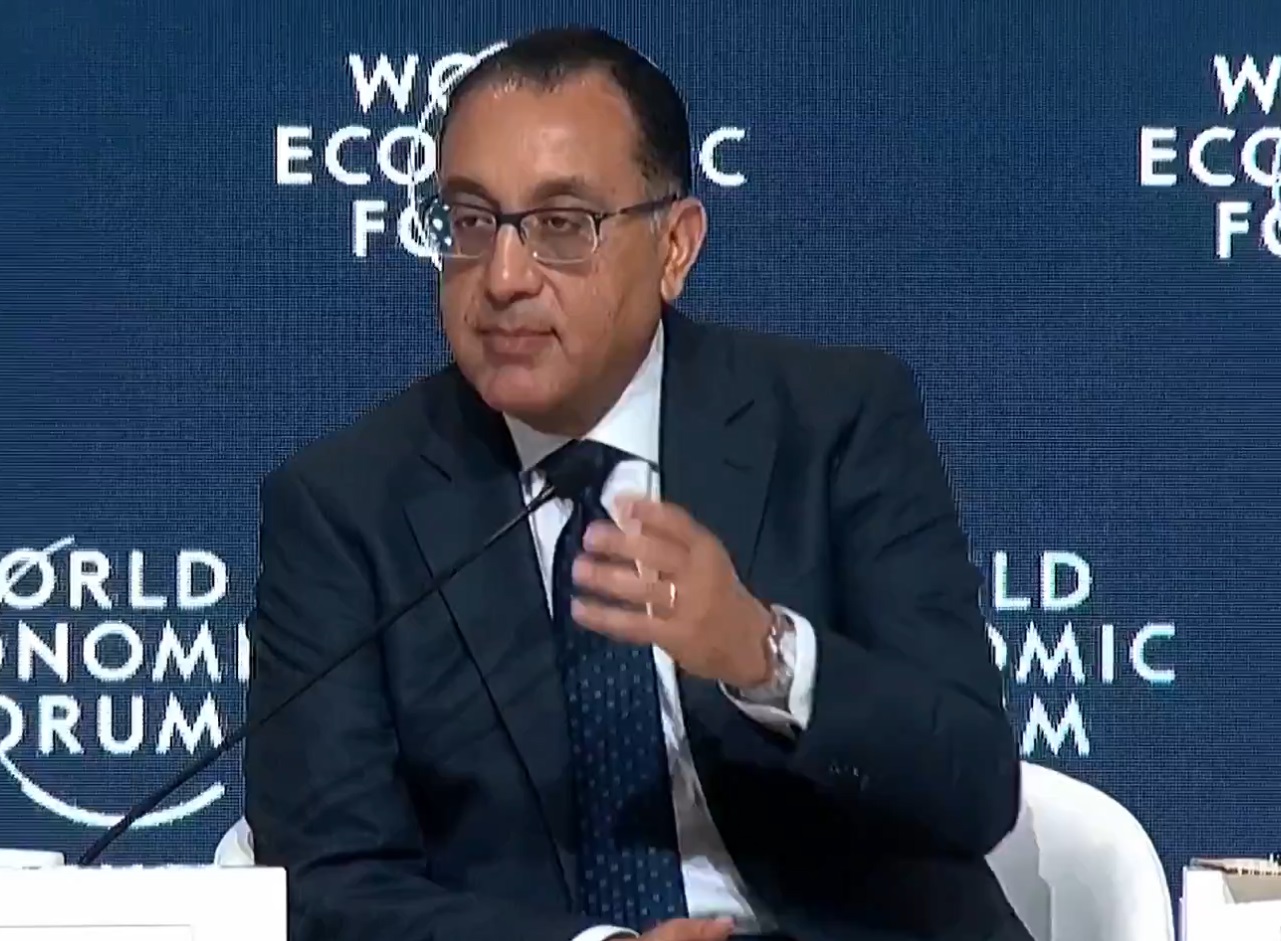

Watan-Prime Minister Dr. Mustafa Madbouly of Egypt sparked controversy with his statements regarding the Palestinian issue and resistance in Gaza, on the sidelines of his participation in the World Economic Forum in the Saudi capital, Riyadh.

Madbouly criticized the Palestinian resistance, stating that Egypt unequivocally condemns what happened on October 7, referring to the Al-Aqsa Flood operation, which he described as a “nightmare.”

Madbouly said, “What happened on October 7 was a nightmare for humanity,” adding, “Let me start by saying that Egypt, from the very beginning, declared its position… that we are against any attacks on civilians from both sides, so we absolutely do not support what happened on October 7 against Israeli civilians.”

رئيس مجلس الوزراء المصري مصطفى مدبولي، خلال #المنتدى_الاقتصادي_العالمي_في_السعودية: #مصر تستوعب أكثر من 9 ملايين لاجئ سنويا من جميع أنحاء المنطقة وأفريقيا، ونقدر التكلفة المباشرة لاستضافتهم بأكثر من 10 مليارات دولار سنوياً#اقتصاد_الشرق pic.twitter.com/MfgiMb0M0t

— اقتصاد الشرق – مصر (@AsharqbEGY) April 29, 2024

He continued, “However, the repercussions that followed from Israel were unacceptable. They collectively punished the Palestinians in Gaza and not just Hamas.”

The Egyptian Prime Minister also stated in Riyadh that Egypt is prepared for a humanitarian operation in Rafah, but politically “this will end the Palestinian issue,” according to him.

He added, questioning, “How can we agree to establish a Palestinian state without a population?!”

Exploiting the Refugee Crisis

In an attempt to garner more financial support and exploit the refugee crisis, Egyptian Prime Minister Mustafa Madbouly also addressed the refugee crisis in Egypt during his speech at the World Economic Forum in Saudi Arabia.

رئيس الوزراء مصطفى مدبولي يقول خلال المنتدى الاقتصادي العالمي بالرياض إن مصر لا تدعم ما حدث للمدنيين الإسرائيليين في 7 أكتوبر لكن التبعات من الجانب الإسرائيلي كانت غير محتملة pic.twitter.com/wSiP0hzJyL

— الجزيرة مصر (@AJA_Egypt) April 29, 2024

He said, “Egypt hosts more than 9 million refugees from all over the region and even from Africa, and estimates the direct cost of hosting them at more than $10 billion annually.”

He also pointed out in his speech that more than 84% of healthcare facilities in Gaza have been destroyed, the education system is out of service, and more than 70% of infrastructure has been destroyed.

He added during his speech on the sidelines of the World Economic Forum in Riyadh, “We managed to stop the fighting and started to look into and plan for the future of the Gaza Strip. We need only a few years to return to the situation before October 7.”

The stance of Sisi and his regime regarding the siege of Gaza is met with popular anger in Arab circles, with accusations against Sisi of participating in tightening the noose on Gaza to gain Western support by exploiting the Rafah crossing card.